The AI landscape was shaken by the release of DeepSeek AI, a large language model (LLM) that rapidly gained traction due to its advanced capabilities and open-weight access. While AI advancements typically unfold gradually, DeepSeek AI’s arrival sent immediate ripples through the global economy, triggering reactions that even industry veterans hadn’t anticipated. From the dip in NVIDIA’s stock price to potential shifts in the AI arms race, the impact of this new model has been nothing short of monumental.

Before moving further, since this article is the second one in the series of posts about DeepSeek, I suggest reading this one first:

DeepSeek AI: The New AI Powerhouse Disrupting the Industry

DeepSeek AI: The Unexpected Challenger

DeepSeek AI, developed in China, positioned itself as a direct competitor to OpenAI’s GPT-4, Google’s Gemini, and Meta’s LLaMA. Unlike many Western counterparts, DeepSeek’s release strategy focused on openness, making it more accessible to researchers and developers. This move signaled a shift in the AI development paradigm, but more importantly, it catalyzed financial and market disruptions across major tech sectors.

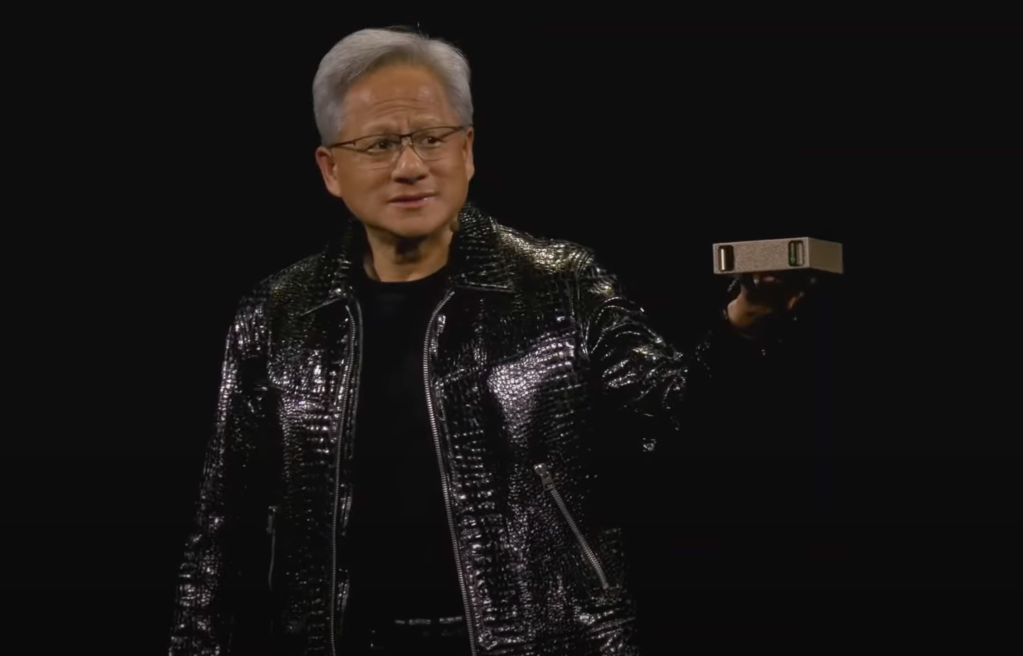

NVIDIA’s Stock Plunge: The AI Market Reacts

Within days of DeepSeek AI’s release, NVIDIA’s stock experienced a noticeable dip. This reaction stemmed from multiple factors:

- Market Fear of Open-Source AI – NVIDIA’s success in recent years has been tied to the AI boom, with its GPUs fueling models like ChatGPT. However, DeepSeek AI’s open-weight release raised concerns about a shift towards decentralized AI development, reducing reliance on proprietary cloud-based models.

- Chinese AI Acceleration – The rise of a powerful AI competitor from China raised questions about the global AI race. Investors speculated that DeepSeek AI’s emergence could lead to faster AI adoption in China, lessening dependence on U.S. tech giants.

- Shift in GPU Demand – If open-weight AI models like DeepSeek continue gaining traction, AI developers might opt for alternative hardware solutions, impacting NVIDIA’s dominance in the AI compute sector.

Tech Giants Reassess Their Strategies

The implications of DeepSeek AI extended beyond NVIDIA. Companies like OpenAI, Google, and Microsoft have closely monitored how its capabilities and adoption unfold. This led to several strategic reassessments:

- OpenAI & Google: Balancing Openness and Monetization – While OpenAI has restricted API access to its most powerful models, DeepSeek’s approach reignited debates over open AI development. Google’s Gemini project has also faced pressure to remain competitive in the wake of this disruption.

- China’s AI Independence – DeepSeek AI marks another step toward China’s self-sufficiency in AI research. With increased government backing, Chinese firms may accelerate AI innovation, creating new competitors in the global market.

- A Decentralized Future? – The rapid adoption of DeepSeek AI underscores the growing appeal of decentralized AI development. If this trend continues, AI innovation could shift away from centralized corporate control, allowing independent developers to shape the future of artificial intelligence.

I suggest reading this article: The Connection Between AGI and the Singularity: Unraveling the Future of Humanity

Broader Economic Implications

Beyond NVIDIA’s stock movement, DeepSeek AI has sparked discussions about AI’s economic influence in broader terms:

- Job Market Disruptions – As AI capabilities expand, companies might reconsider workforce needs, potentially automating more roles.

- Investment Shifts – AI investors are now considering whether to diversify into open-weight models and decentralized AI startups.

- Regulatory Uncertainty – Governments worldwide are assessing how to regulate AI amid rapid advancements, and DeepSeek AI’s emergence has added urgency to these discussions.

I suggest reading this article: The Future of AI in Everyday Life: What’s Coming in 2025?

Conclusion: A Watershed Moment for AI Economics

DeepSeek AI’s sudden impact on the tech industry proves that AI innovation isn’t just about new capabilities—it’s also about economic consequences. The reaction from investors and tech companies suggests that we are witnessing a major shift in how AI is developed, distributed, and monetized. Whether this trend continues or stabilizes, one thing is clear: AI is no longer just a technological marvel; it’s an economic force capable of reshaping global markets overnight.